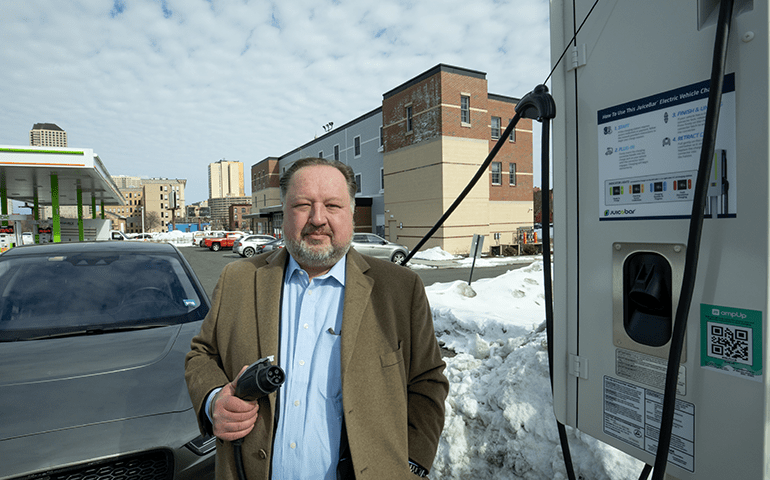

Two years after acquiring Greater Hartford-based electric vehicle charger manufacturer and distributor JuiceBar, Paul Vosper is preparing his company for a major ramp up.

JuiceBar — formerly based in Hartford but with present-day operations in East Hartford and Norwalk — plans to approximately double its 21-person staff in the year ahead. Its contract manufacturing provider in Oxford will also likely double its 20-person workforce.

“Our aspiration is to be the largest charging company in the country,” said Vosper, who was in the finance industry before his 2018 purchase of JuiceBar. “That mantle is up for grabs.”

Officials at Enfield-based EVSE LLC, a fellow homegrown electric vehicle charger maker, are feeling the same enthusiasm.

Daniel Shanahan, EVSE’s director of sales and marketing, said the company’s charger sales pipeline has seen solid growth in recent months, and it also anticipates more hiring in the near future.

“Adoption [of electric vehicles] momentum is accelerating,” said Shanahan, whose company is a subsidiary of Control Module Inc., an Enfield-based designer and manufacturer of smart EV chargers and other technology that has about 60 employees. “Critical mass is happening.”

Part of the reason the two Greater Hartford companies have bullish outlooks is because of the recent EV commitments made by major car manufacturers, including General Motors, which in January became the first major U.S. automaker to pledge to phase out internal combustion model vehicles by 2035.

President Joe Biden’s initiative to install 500,000 EV chargers across the country this decade, and hopes that he will lift caps on federal tax credits for EV purchases, are also spurring excitement.

Amid those broader developments, there’s a potential sea change in Connecticut’s EV and charging policies.

While the state has mostly not been a standout when it comes to EV adoption, there are significant policy changes converging right now that environmental advocates hope will shift into high gear a long-envisioned transition from fossil fuel vehicles to EVs.

“When you look out the front windshield, there’s a lot ahead when it comes to electric vehicles,” said Katie Dykes, commissioner of the state Department of Energy and Environmental Protection (DEEP).

Among the most significant is Gov. Ned Lamont’s support of Connecticut joining the Transportation and Climate Initiative (TCI), a cap-and-invest program that would auction pollution allowances to fuel producers, raising an estimated $80 million per year that the state would use for public transit and EV infrastructure. TCI, to which several other governors have also committed, is expected to result in price increases at the pump for motorists.

While lawmakers consider Lamont’s TCI proposal, the state Public Utilities Regulatory Authority (PURA) is weighing potentially generous industry incentives, which could result in EV charger purchase and installation rebates of up to $2,500 for homeowners and $40,000 per apartment community.

If approved, the so-called “make ready” program would be run by utilities Eversource and United Illuminating, which would recover the costs from Connecticut ratepayers in future electricity bills.

Such incentives would bring Connecticut up to speed with California, Massachusetts and some other leading EV states.

“I think that’s one of the bright spots in Connecticut,” Barry Kresch, president of the Electric Vehicle Club of Connecticut, said of the proposed charging incentives. “It’s going to lower the total cost of ownership to have an electric vehicle.”

Kresch has been a critic of Connecticut’s EV purchase rebate program, known as CHEAPR, which has excluded pricier electric vehicle models, including some made by market share leader Tesla.

Kresch said that policy decision is hurting Connecticut’s chances at reaching its EV and environmental targets.

“The only state where we could be considered comparably impressive against is a state without any incentives at all,” Kresch said.

CHEAPR rebate volume plummeted in 2020, even though electric vehicle registrations in the state climbed 18%.

DEEP is retooling CHEAPR’s incentive structure at the legislature’s direction, adding used-vehicle and low-income components. But the agency had not announced any specific changes as of press time.

Dykes said the fact that higher-end EV models continue to sell shows that the rebates may not influence buying decisions.

“We’re not trying to create windfalls,” she said. “EVs are for everyone.”

Internal combustion remains dominant

Connecticut has seen steady increases in the number of electric vehicles on the roads in recent years.

Even during the pandemic, the total number of battery electric and plug-in hybrid cars registered with the state’s Department of Motor Vehicles climbed 18%.

However, that’s still only 13,800 EVs, or under 1% of the approximately 2.4 million light-duty fossil fuel cars and trucks registered in the state.

Meanwhile, the clock is ticking on Connecticut’s goal of putting 125,000 EVs on the road by 2025, a benchmark set under a 2014 memorandum of understanding with California and a group of other states.

The goal gets steeper by 2030, when 500,000 EVs will be needed in order to reach the state’s commitment to reduce greenhouse gas emissions from the transportation sector by at least 45% below 2001 levels by 2030.

Those EV targets may seem unachievable, given the historic pace of adoption in the state, but Dykes said she expects that falling EV prices, increasing buy-in from automakers, a Democratic presidential administration, and Connecticut’s ongoing policy efforts will lead to a significant acceleration.

“The good news is we have a partner in Washington now that prioritizes action on the climate,” she said. “The engines of our economy are working towards reducing emissions, and that’s really good news.”

Connecticut recently ranked 13th in an EV ranking from the American Council for an Energy-Efficient Economy, which uses various data points — from EV adoption rates to rebates and incentives — to rank states.

Converging initiatives on the state and federal levels will boost Connecticut’s standing in the years ahead, predicts Bryan Garcia, CEO and president of the quasi-public Connecticut Green Bank, which is working to make EV chargers a standard offering in its efficiency financing program for commercial buildings, C-PACE.

“I think we’re going to see Connecticut within the top 10, easily,” Garcia said.

EV workforce quality

At JuiceBar, Vosper said he is excited his company’s home state is working to catch up to EV leaders like California, New York and Massachusetts, where charging incentives have been more robust.

“Right now, Connecticut is behind other states in infrastructure,” he said, particularly on highway chargers.

“And it’s a chicken-and-egg problem: No one buys an EV if they can’t charge it.”

While the state has lagged in some ways on EV policy, Vosper said it’s been a desirable home for a charger manufacturer, as the state’s advanced manufacturing base has provided the skilled employees — from electricians to programmers to metal benders — that JuiceBar needs.

“We haven’t had a problem finding talented people,” he said. “We’ve looked at other locations, we’ve looked at offshoring and we could probably save a little bit of money on labor costs by going to China or India, but we picked that back up again in shipping costs. We’re able to get very good quality control by having everything here in the state.”

JuiceBar and EVSE must keep focused on major EV states, which account for the bulk of the nearly 7,000 charging ports they’ve collectively installed, but are looking forward to an expected surge in home-state business from PURA’s proposed incentives and other programs.

“It’s a major initiative and it will provide the momentum to get the state to its EV goals, definitely,” said Shanahan of EVSE, which has carved out a niche in chargers with fully retractable cables, a design the company markets as safer and compliant with disability access laws.

Shanahan is also hoping the proposed Connecticut incentive programs will help EVSE’s new utility-pole-mounted charger gain a foothold in the market here, after initial rollouts with utilities in California and Massachusetts.

EVSE has more than 350 charging ports in Connecticut, including at college campuses like UConn, in state parks and beaches, and at various state agency facilities, including DEEP’s Hartford headquarters.